Proyecto De Ciencias

Proyecto De Ciencias

Integrantes:

- Luis Cevallos

- Doumary Molina

- Karla Mendoza

- Scarlet Miranda

- Juan Gonzales

Proyecto de Comprensión: Art Of Time

Marco Teórico

The Oil In Ecuador

In Ecuador, the first oil well was discovered in Ancón, peninsula of Santa Elena, the English company Anglo. However, production at commercial levels did not occur until 1925 and export in 1928, although in marginal quantities. Until 1971, oil exports did not exceed 6% of total exports of Ecuador, according to data from the Central Bank.

In Ecuador, the first oil well was discovered in Ancón, peninsula of Santa Elena, the English company Anglo. However, production at commercial levels did not occur until 1925 and export in 1928, although in marginal quantities. Until 1971, oil exports did not exceed 6% of total exports of Ecuador, according to data from the Central Bank. Between 1928 and 1957, the country exported 42 million barrels of crude, equal to the volume exported only in 1972, the year in which the era of the oil boom was inaugurated. For nearly forty years, from 1928 to 1959, the exploitation of crude was concentrated in the peninsula of Santa Elena.

"Oil Boom (1972-1979)"

First Boom

The oil era in Ecuador began definitively in 1972, when the Transecuadorian Pipeline System (SOTE) was inaugurated. The price per barrel in that year was $ 2.50 and around 25 million barrels were exported, which meant an increase of 46.9% in the revenues of the Central Government compared to 1971. The public sector, which handled the sector oil industry, began to have an increasing participation in the economy. Thus, the revenues of the Central Government, which in 1971 represented 12.1% of GDP, in 1978 amounted to 21.2%. Between 1972 and 1978, public revenues grew on average to 37.3% annually, compared to 10.4% for the period 1966-1971. However, since 1974 crude production stagnated at around 74 million barrels per year. What increased, thanks to international events such as the Yom Kippur War, was the price, which in 1978 reached $ 12.5 per barrel 10 dollars more than in 1972.

As a result of the first oil boom, the composition of Central Government revenues changed markedly. In 1971, tax revenues represented 81% of the total and in 1979 barely 42.3%, that is to say, their participation was reduced by almost half. On the contrary, the share of oil revenues went from 6.3% to 36.6% in the same period. The sustained increase in available resources allowed the Central Government to increase its expenditures, which grew at an average annual rate of 32.2% between 1972 and 1978. As a result, throughout that period there were fiscal deficits, except in 1974, when a surplus of $ 97 million was reached, equivalent to 1.5% of GDP. In 1977, the deficit reached 3.1% of GDP.

"Oil Boom (2007-2014)"

Second Boom

At the end of 2003, with the construction of the Heavy Crude Oil Pipeline (OCP), Ecuador increased its oil production by 25% and oil exports increased by 40%. In addition, this increase occurred in a favorable environment for oil prices. In May 2006, the Ecuadorian State canceled the contract with the North American company Occidental (OXY), which operated Block 15, which, from that date on, was exploited by the State. In this way, the participation of state companies in total crude production reached 51%. However, production remained below the record of 195 million barrels reached in 2006 until 2014, when 203 million barrels were extracted. Despite lower efficiency in production levels, oil revenues soared during the second boom thanks to rising oil prices.

One of the most important events in the regulatory framework during the second oil boom was the "Reform Law to the Hydrocarbons Law and the Internal Tax Regime Law", published in the Official Gazette in July 2010. This law determined that "in contracts for the provision of services for exploration and exploitation of hydrocarbons contractors as Operators are not subject to the payment of royalties. The entire production of the contract area is owned by the State. "In addition, regarding the provision of services it was determined that within the income from the production of a certain area, the Ecuadorian State reserves 25% of the gross income as a margin of sovereignty. These changes allowed for 2011 the national oil production of public companies to represent 72% of the total. In that same year the riots in the Arab countries allowed the price of Ecuadorian crude to increase by 35% and reach $ 97 per barrel.

The revenues of the Central Government grew at an average annual rate of 17% between 2007 and 2009 and of 11% between 2010 and 2013 [1]. In the first period, oil revenues grew by 14% per year and in the second period by 2%. Meanwhile, non-oil revenues grew 17% in the first period and 14% during the second. On average, between 2007 and 2009 oil revenues accounted for 25% of the total and between 2010 and 2013 30%. On the other hand, Central Government spending increased at an average annual rate of 17%, between 2007 and 2009, and to 14% between 2010 and 2013. Capital expenditure grew at 42% per year in the first period and at 22% in the second, while current expenditure was 22% and 13%, respectively. Between 2007 and 2009 the salaries and wages of the Central Government increased at an average annual rate of 27% and between 2010 and 2013 they grew to 9%. During the second oil boom, despite the growth in revenues, public debt went from representing 20.8% of GDP in 2007 to 29.8% in 2014.

Introduction

Good morning, welcome to a new broadcast of Cristo Reydio, today we are going to analyze a very crucial and very necessary topic, which still has repercussions in the present, we are talking about the crisis of the equator in the last century, for be more precise the one that started in 1972 and which ended in 2007.

Context

The first thing that will be analyzed will be how the crisis began, which led to Ecuador's continued indebtedness after having large oil wells and great wealth to have.

In addition to that, we will talk about the given ungovernability and the next crisis that came, called Dollarization.

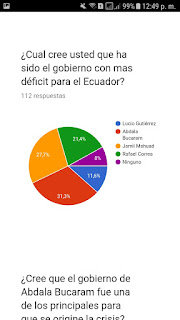

Datos Estadisticos

Comentarios

Publicar un comentario